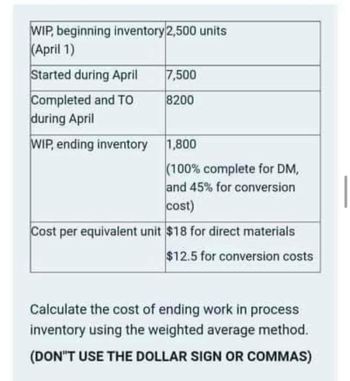

So, if the manufacturing unit had totally different prices for chocolate bars at different times, the Weighted-Average methodology would add up all the prices and divide by the total number of bars produced to get a single average cost per bar. This makes it easier to calculate costs when there are numerous totally different costs over a period. First, we have to know our whole prices for the interval (or whole prices to account for) by including starting work in process prices to the costs incurred or added this period. Then, we examine the entire to the price assignment in step 4 for units accomplished and transferred and ending work in process to get total items accounted for. First, we have to know our total costs for the period (or total prices to account for) by adding starting work in process costs to the costs incurred or added this period. Accountants often assume that items are on the same stage of completion for both labor and overhead.

In this case, we might monitor the prices of supplies, labor, and overhead for every specific job individually. Both strategies help businesses understand and manage their manufacturing costs, but they are utilized in different conditions primarily based on the type of products being made. An equal unit of production is an expression of the quantity of labor carried out by a manufacturer on models of output which would possibly be partially completed on the end of an accounting interval. Mainly the totally accomplished items and the partially accomplished units are expressed by means of absolutely completed units. We wish to ensure that we have assigned all the costs from beginning work in process and costs incurred or added this period to models accomplished and transferred and ending work in course of inventory.

Step 1: Equivalent Models Of Starting Wip

For example, if we have 3 models 1/3 of the way complete, we are able to add them together to make 1 equivalent unit (1/3 + 1/3 + 1/3). We could make this calculation simpler by multiplying the models by a percentage of full. In the present period, we transferred 500 units to process 2, and have 350 equivalent items in our WIP inventory. So our equal units of production for the period could be 850 items.

- Ending WIP is listed on the company’s stability sheet along with quantities for raw supplies and finished goods.

- The supplies prices consisted of $30,000 in beginning inventory and $88,000 incurred in the course of the month, for a total of $118,000.

- Since the utmost number of models that might possibly be accomplished is 8,seven-hundred, the number of items in the shaping department’s ending stock must be 1,200.

- In this method, both the start and ending stock is converted into equal models, so there is somewhat more work to do.

In this article, you will note the comparison between FIFO and weighted common, with an easy to grasp example. FIFO, WA, and EU are all instruments used to calculate the cost of producing products. Equal models assist measure the manufacturing exercise by converting partially completed products into an equivalent variety of absolutely accomplished products. The FIFO technique uses these equal items by assigning the oldest prices to the units completed first, which helps track prices within the order they had been incurred. The Weighted-Average method, on the other hand, averages out all the prices over the period, utilizing equivalent items to discover a single price per unit for both accomplished and partially accomplished how to calculate the started and completed units merchandise.

No items have been misplaced to spoilage, which consists of any models that aren’t fit for sale as a end result of breakage or other imperfections. Since the utmost variety of units that might presumably be completed is eight,seven-hundred, the number of items within the shaping department’s ending stock must be 1,200. The complete of the 7,500 units accomplished and transferred out and the 1,200 items in ending stock equal the 8,700 possible units in the shaping department.

While equivalent models could be calculated manually or in a spreadsheet, corporations can even use value accounting software program to automate the calculation. This eliminates guide https://www.personal-accounting.org/ errors and saves significant time for the accounting group. The software program seamlessly pulls in beginning and ending WIP data andcompletion percentages to output the equal unit figures. In the world of producing, an organization’s inventory is an important aspect of its operations. It represents the uncooked materials, work-in-process (WIP), and finished goods which may be available on the market. Work-in-process inventory, specifically, refers to the partially accomplished goods which may be still undergoing production.

Step 3: Equivalent Units Of Ending Wip

For instance, a manufacturing unit is making chocolate bars they usually have 200 bars which may be midway done at month-end. Instead of counting these as 200 incomplete bars, we use equivalent units to measure them. Since they’re halfway carried out, it’s like having 100 absolutely completed chocolate bars. This helps the manufacturing unit calculate costs more precisely for the partially finished products. Process costing is used to figure out how much it prices to supply objects that are very comparable or similar, like chocolate bars or cans of soda. In this costing system, prices are tracked for every step, or “process,” within the production, after which the whole price is divided by the variety of models produced.

Determining the worth of the work in course of inventory accounts is difficult as a end result of each product is at various stages of completion and the computation must be done for each division. Trying to determine the worth of those partial phases of completion requires application of the equal unit computation. The equal unit computation determines the number of items if every is manufactured in its entirety earlier than manufacturing the following unit. For instance, forty models which are 25% complete could be ten (40 × 25%) models which would possibly be totally complete. Equivalent items of manufacturing for conversion costs uses the percentages of conversion prices accomplished in Could which are given to mathematically convert partial units to whole items for costing purposes.

These quantities are the goals of course of costing and can be used to discover out progress and for comparability purposes over time. FIFO (First-In, First-Out) and WA (Weighted-Average) are methods used to assign prices to items produced. FIFO assumes that the oldest costs are assigned to the items accomplished first. For instance, for a manufacturing facility is making chocolate bars, FIFO means the cost of the elements and labor from the start of the production interval are used first to calculate the worth of the completed bars. This helps to trace the flow of prices extra precisely based mostly on the production timeline. On the opposite hand, the Weighted-Average method blends all the prices together to search out a median cost per unit.

All of the items transferred to the subsequent department must be one hundred pc complete with regard to that department’s value or they’d not be transferred. So the number of items transferred is the same for materials items and for conversion models. The process price system must calculate the equivalent units of production for models completed (with respect to supplies and conversion) and for ending work in process with respect to materials and conversion.

It’s useful for firms making massive quantities of comparable merchandise as a outcome of it helps them perceive cost per item. Essentially, the concept of equivalent models involves expressing a given variety of partially completed models as a smaller number of absolutely accomplished models. We do this as a result of it is easier to account for entire items then elements of a unit.